Please provide your information and submit this form. Our team will be in touch with you shortly.

Retirement Planning

Retirement Planning

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, and personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Listing View:

What to Do with Your Retirement Account If You Change Jobs

ARTICLE - 4260 Views

How to Review Your Online Social Security Statement

ARTICLE - 1919 Views

A Guide to Senior Living Contracts: Types of CCRC Agreements Explained

ARTICLE - 1843 Views

What Is an Annuity?

ARTICLE - 1393 Views

How Will Rising Healthcare Costs Affect Your Retirement?

ARTICLE - 1392 Views

Many People Don’t Plan for the Reality of Retirement

ARTICLE - 1363 Views

Women and the Retirement Crisis

ARTICLE - 1286 Views

For a Successful Retirement, Start Talking About It Now

ARTICLE - 1192 Views

Basics of Retirement Planning

ARTICLE - 1164 Views

Put Your Retirement Savings on Autopilot

ARTICLE - 1143 Views

3 Steps to Save for Retirement When You’re Self-Employed

ARTICLE - 1136 Views

How Do You Turn Retirement Savings into Retirement Income?

ARTICLE - 1124 Views

Unique Issues Women Face When Planning for Retirement

ARTICLE - 1116 Views

TRADITIONAL VS. ROTH IRA

ARTICLE - 1068 Views

How Can I Afford My Retirement?

ARTICLE - 1047 Views

Your Personal Wealth Generator: Leveraging Your Small Business to Secure Your Financial Future

ARTICLE - 1026 Views

Retirement: You’ve Got This!

ARTICLE - 1015 Views

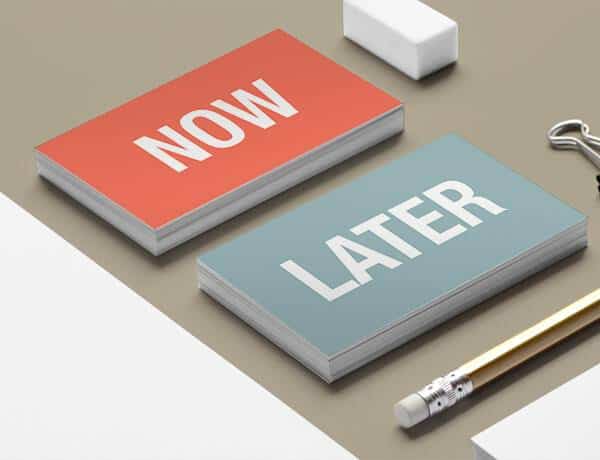

THE COST OF PROCRASTINATION

ARTICLE - 1004 Views

To Retire with Confidence, Have a Plan

ARTICLE - 992 Views

VOLUNTEERING IN RETIREMENT

ARTICLE - 987 Views

Aspen Retirement Planning

Retirement Planning blogs matches your answers

FREE CONSULTATION

Need a second opinion on your portfolio?