Please provide your information and submit this form. Our team will be in touch with you shortly.

By Jim Davis, CFP®

One of the most common ways hardworking and dedicated corporate leaders build wealth is through the accumulation of various forms of executive compensation, often including stock options of various types. As we’ve written previously, the great advantage of such compensation is that it aligns the executive’s benefit with the continued wellbeing of the company; as the company continues to grow and thrive, the value of the incentive compensation continues to increase. In fact, one of the chief ways successful executives can build wealth is by accumulating valuable company stock by means of various executive compensation packages.

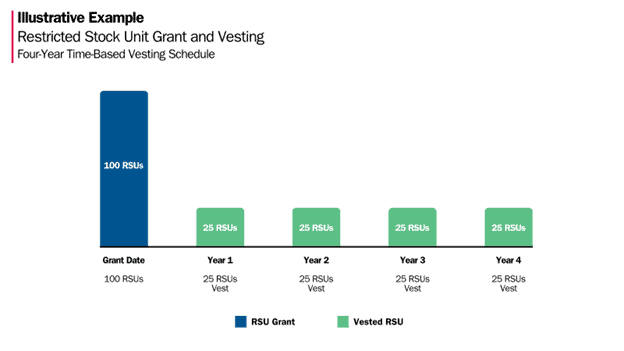

One of the principal forms of executive stock options is the restricted stock unit (RSU). Simply put, RSUs consist of company stock granted to the executive according to a vesting schedule that determines when the grantee is able to exercise full ownership. The “restricted” part of the name derives from the fact that there are limitations on the owner’s ability to sell the stock represented by the units.

For example, suppose that, as part of your executive compensation package, you receive 1,000 RSUs with a four-year vesting schedule. This means that 25% of the stock is vested each year, and after four years the 1,000 RSUs are fully vested—the grantee has full ownership and is able to sell the shares at whatever the market price is at that time.

This is where some strategic thinking is called for, however. Before you make the decision to sell, there are several factors to consider, including (but not limited to) compensation plan restrictions, taxation, and overall portfolio strategy. Let’s take a closer look at these three factors.

Perhaps the most important thing to know about your package is the vesting schedule for your RSUs. Do they vest immediately, or over a period of years? With some plans, vesting is tied to a liquidity event such as a change in ownership, an IPO, or an exchange listing, or to the achievement of certain performance goals. You will want to be familiar with your plan’s vesting requirements to avoid any surprise ownership events that could trigger unwanted tax responsibilities. Additionally, you’ll want to understand your options around receipt of the shares represented by the RSUs: Can you defer distribution to a future date, such as retirement? Are dividends accrued while you hold the RSUs?

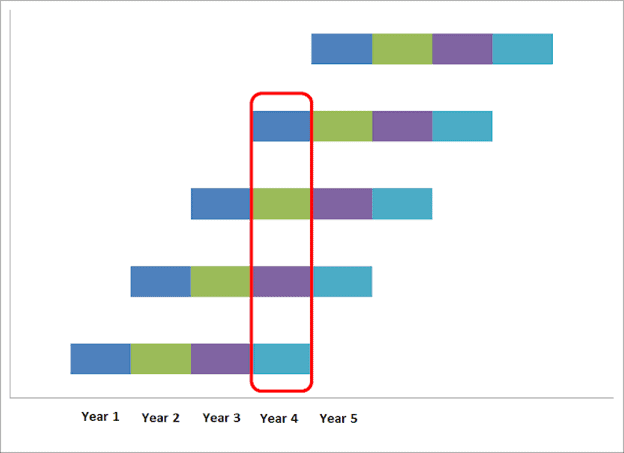

You should also consider how termination or a change of employment could affect your plan benefits. For example, if you are only partially vested in the plan and you decided to leave for another employer, what portion of your units would you be able to take with you? If your new employer has a compensation plan that includes RSUs, how long will it take you to enter or complete the vesting schedule? Depending on the differences between the two plans, it might make sense to delay your job change until a time more advantageous to you.

Next, you should carefully consider the potential tax consequences of both vested shares and sale of shares acquired through RSUs. While there is typically no tax liability involved in being granted RSUs, there are tax implications that come with full ownership and sales of shares. When you are vested and shares are transferred to you, the fair market value (FMV) of those shares is imputed as taxable compensation. This can affect your cash flow, since you will be required to pay taxes on the vested units. Also, your employer may be required to withhold a portion of the shares to cover estimated taxes. And when you sell, any profit above the value of the shares when you received them would be taxed as either long- or short-term capital gains—another event that can put a dent in your cash flow without proper planning. You may decide to simply sell some shares to cover the amount of the tax. Or, if you don’t want to reduce your share of ownership, you might decide to put extra money into savings to pay the tax—or, if possible, adjust your withholding to offset the anticipated tax burden.

Depending on the amount of shares you are receiving, you may also wish to defer receipt (if your plan allows it) or to use tax-offset strategies such as increasing your contribution to a tax-advantaged company plan—such as a 401(k)—or “bunching” charitable deductions in order to offset some or all of the taxable amount represented by the vesting of the RSUs. As you approach the vesting event, it is wise to spend some time with your tax and advisor and financial planner to project cash flow needs and consider tax mitigation strategies.

Of course, it is essential to consider the impact of RSU vesting on your overall portfolio strategy. For many executives, vesting of RSUs and other stock options can result in a large percentage of personal wealth concentrated in the value of a single asset—company stock. Holding such a concentrated position poses obvious risks: a large portion of your overall wealth—frequently, a majority—is dependent on your company stock holding or increasing its value. If the company were to fall on hard times, perhaps because of an adverse economy, your wealth would decline to the same degree. For this reason, it may be important to consider strategies for unwinding the concentrated position and reallocating the proceeds to achieve a more diversified, balanced portfolio. This is where a professional, fiduciary financial advisor can be particularly helpful. Your financial advisor, familiar with your overall financial situation and goals, can work with you to develop tax-efficient strategies for liquidating some or all of your concentrated position and reallocating assets in accordance with your overall strategy. Or, if liquidation is unadvisable, your advisor may be able to suggest other strategies for hedging your risk, such as buying put options or increasing your position in assets that are negatively correlated with your company stock.

At Aspen Wealth Management, we know that the decisions surrounding RSUs and other forms of incentive compensation can seem a bit bewildering. We work with clients to “de-mystify” the process and develop plans that match the client’s overall goals and tolerance for risk. To learn more, visit our website to read our article, “Equity Compensation and Your Financial Plan.”