Please provide your information and submit this form. Our team will be in touch with you shortly.

If there’s one thing that people preparing for retirement understand thoroughly, it’s the need to build up the “nest egg” as much as possible. And as financial advisors, we are constantly preaching the same message: put as much as you can into your tax-advantaged accounts (401(k)s, 403(b)s, IRAs, etc.) and your regular investment accounts so you’ll have plenty of funds as you begin your retirement.

What we tend to think about less—though it’s just as important—is the method we’re going to use for taking those funds back out again, when it’s time to start using them in retirement. Oddly, many people, especially those preparing for retirement, don’t consider the importance of a withdrawal strategy. Instead, most investors are focused on making sure they are putting enough money in their various “buckets” and are less concerned with how they will take it out.

But consider: the average American is expected to live between 20 and 22 years past their 65th birthday, according to the Social Security Administration. In fact, about a fourth of those age 65 today can expect to live past age 90, and about 10% will live past 95. In other words, many of us will live 30 years or more in retirement. And as time goes on, average life spans may be expected to increase. This means that we should be giving careful thought to the best ways to extend our retirement income streams as much as we can, while also paying the least possible in taxes, including the portion of Social Security income that is subject to taxation. Retirement income withdrawal strategies should consider taxable and non-taxable sources of income, along with the growth and volatility characteristics of assets in all accounts.

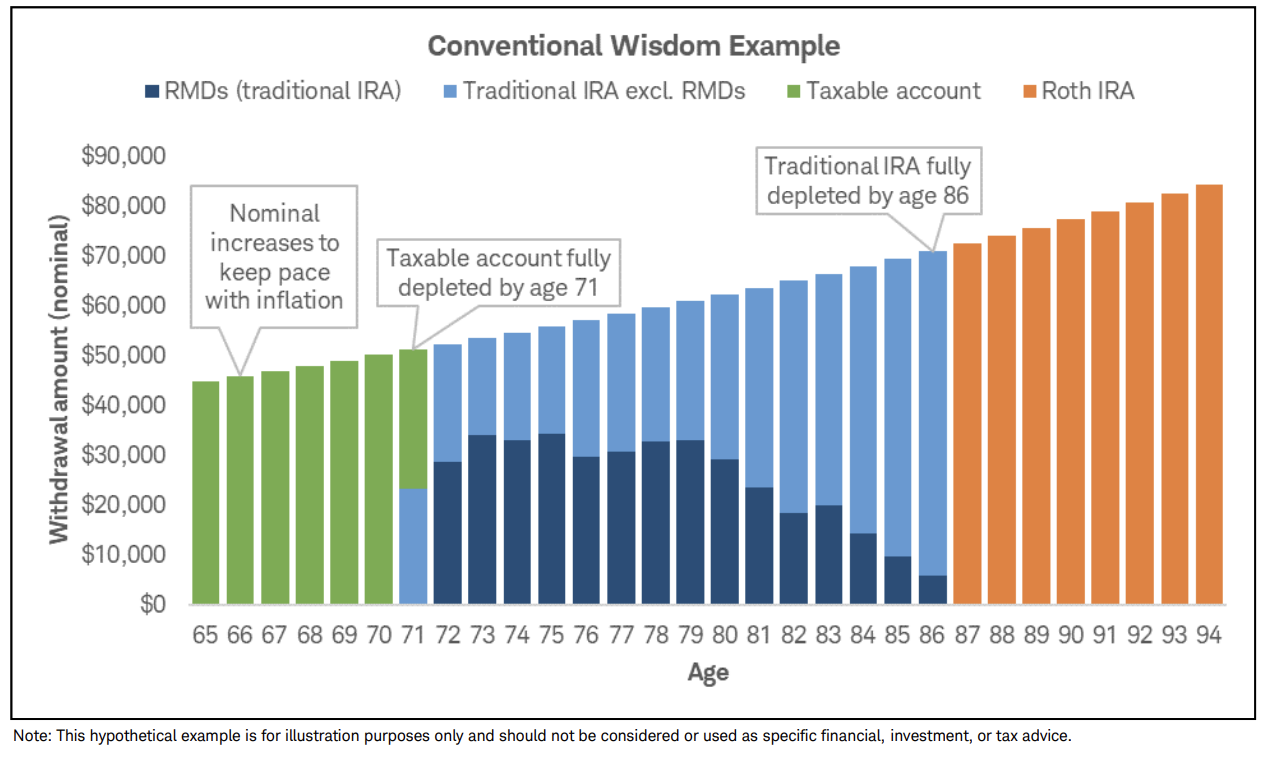

Traditionally, the advice has been to spend down taxable accounts first (regular investment accounts), then tap tax-deferred sources (traditional retirement accounts like IRAs, 401(k)s, or 403(b)s funded with pre-tax dollars), and finally, to utilize sources of tax-free income (such as Roth retirement accounts, which are funded with after-tax dollars). This is a pretty easy concept to grasp, and it does offer the advantage of allowing tax-deferred and tax-free sources to grow and compound without the drag of taxation for as long as possible. Of course, income generated from regular investment accounts is taxable, either as ordinary income (including non-qualified dividends and short-term capital gains), qualified dividends, or long-term capital gains (LTCG); the latter two may be taxed at a rate below the taxpayer’s marginal rate. Income from tax-deferred accounts (like traditional 401(k)s, 403(b)s, and IRAs) is also taxed as ordinary income when the funds are withdrawn from the account. Qualified distributions from Roth accounts are not taxed.

Source: Charles Schwab

But the “conventional wisdom” sometimes overlooks a couple of important factors for retirement income: the effect of required minimum distributions (RMDs) and the impact on the taxation of Social Security income.

First, keep in mind that under current law, the first $32,000 of Social Security income for a married couple filing jointly is not taxed. From $32,001–44,000, 50% of it is taxable. Above $44,000, 85% of Social Security income is taxable. This is why a smart withdrawal strategy takes into consideration the amount and character of taxable income being used each year.

Next, don’t forget that balances in tax-deferred accounts like traditional IRAs can’t be left there indefinitely; by age 72, most taxpayers are required to start taking RMDs from these accounts. As RMDs add to the taxpayer’s ordinary income, “bracket creep” can sometimes become a problem.

Finally, remember that the main goal for most retirees is to avoid outliving their money. For others, an auxiliary goal might be to leave as much of the estate as possible for their heirs. For these reasons, some retirees may benefit from another withdrawal strategy that can both result in a lower tax bill during retirement and potentially preserve more of the estate for the next generation.

With all that in mind, some retirees could benefit from a different method than the “conventional wisdom” described above. Rather than allowing tax-deferred accounts to continue accumulating until taxable sources are exhausted, it may make sense to draw some income from these accounts earlier in retirement, paying tax on them as ordinary income. Among other things, this can have the effect of “spreading out” the tax burden on the deferred amounts over a longer span and also potentially reducing the size of the RMDs required in later years. Depending on how much income other than Social Security is available to the taxpayer, this may also keep more of the taxpayer’s Social Security income from being subject to tax. It also continues the benefit of delaying the use of Roth accounts, creating the possibility for a longer stream of tax-free income in the later years of retirement.

By “biting the bullet” a little earlier in retirement and taking measured distributions from tax-deferred sources, many retirees may be able to reduce the amount of taxes paid over their retired lifetimes and potentially conserve more tax-free or tax-advantaged assets for the benefit of their heirs. Of course, any strategy should be carefully discussed with your financial and tax advisors, taking into consideration the specifics of your situation.

At Aspen Wealth Management, we understand that, while building up your accounts is vital to a financially secure retirement, the way you draw from them can be just as important. For more ways to maximize your retirement savings while reducing taxes, we invite you to watch our on-demand webinar: Tax-Smart Retirement: Keeping More of What You’ve Earned. It offers additional strategies and insights to help you make the most of your retirement income. If you have questions about your retirement strategy or any other important financial matter, please get in touch with us.