Please provide your information and submit this form. Our team will be in touch with you shortly.

Addressing the potential threat of long-term care expenses may be one of the biggest financial challenges for individuals who are developing a retirement strategy.

The U.S. Department of Health and Human Services estimates that 70% of people over age 65 can expect to need long-term care services at some point in their lives.1 So understanding the various types of long-term care services – and what those services may cost – is critical as you consider your retirement approach.

What Is Long-Term Care?

Long-term care is not a single activity. It refers to a variety of medical and non–medical services needed by those who have a chronic illness or disability – most commonly associated with aging.

Long-term care can include everything from assistance with activities of daily living – help dressing, bathing, using the bathroom, or even driving to the store – to more intensive therapeutic and medical care requiring the services of skilled medical personnel.

Long-term care may be provided at home, at a community center, in an assisted living facility, or in a skilled nursing home. And long-term care is not exclusively for the elderly; it is possible to need long-term care at any age.

How Much Does Long-Term Care Cost?

Long-term care costs vary state by state and region by region. The 2018 national average for care in a skilled care facility (single occupancy in a nursing home) is $100,380 a year. The national average for care in an assisted living center (single occupancy) is $48,000 a year. Home health aides cost a median $22 per hour, but that rate may increase when a licensed nurse is required.2

What Are the Payment Options?

Often, long-term care is provided by family and friends. Providing care can be a burden, however, and the need for assistance tends to increase with age.1

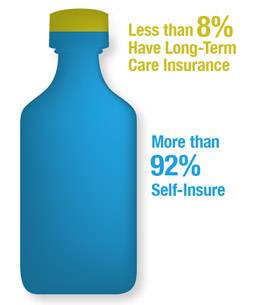

Individuals who would rather not burden their family and friends have two main options for covering the cost of long-term care: they can choose to self-insure or they can purchase long-term care insurance.

Many self-insure by default – simply because they haven’t made other arrangements. Those who self-insure may depend on personal savings and investments to fund any long-term care needs. The other approach is to consider purchasing long-term care insurance, which can cover all levels of care, from skilled care to custodial care to in-home assistance.

When it comes to addressing your long-term care needs, many look to select a strategy that may help them protect assets, preserve dignity, and maintain independence. If those concepts are important to you, consider your approach for long-term care.

The Best-Laid Plans

Source: National Alliance for Caregiving in collaboration with AARP, 2015 (most recent data available)

1. U.S. Department of Health and Human Services, 2019

2. Genworth 2018 Cost of Care Survey