Please provide your information and submit this form. Our team will be in touch with you shortly.

For many people, particularly those with young families, their greatest asset is likely their ability to earn an income in the future. This makes life insurance one of the most important parts of their financial plan. We insure our house against fires and floods and our cars against collisions, so why wouldn’t we insure our greatest asset? It generally comes down to there being too many decisions to make and few objective partners to provide commission-free advice. So, if you can’t distinguish how much benefit you need, what type, and for how long: this series will be a great place to start.

The purpose of life insurance is very simple; it is to replace your income for your dependents after you pass. A life insurance policy is a contract between you and the insurance company. You pay premiums for the defined length of time and the insurance company promises to pay a death benefit to your beneficiary if you die while the policy active. Beware, if you don’t pay the premiums the insurance company may not be obligated to pay the death benefit!

There are four main parties to a life insurance policy:

- The insurer is the insurance company who pays out the death benefit.

- The owner is the person responsible for paying the premiums to the insurance company.

- The policy is based upon the insured’s life.

- The beneficiary is the person or entity that receives the death benefit after the insured passes away.

One of the hardest things to figure out with life insurance is which policy you need because there are so many choices! The following types of life insurance are the most common policies offered.

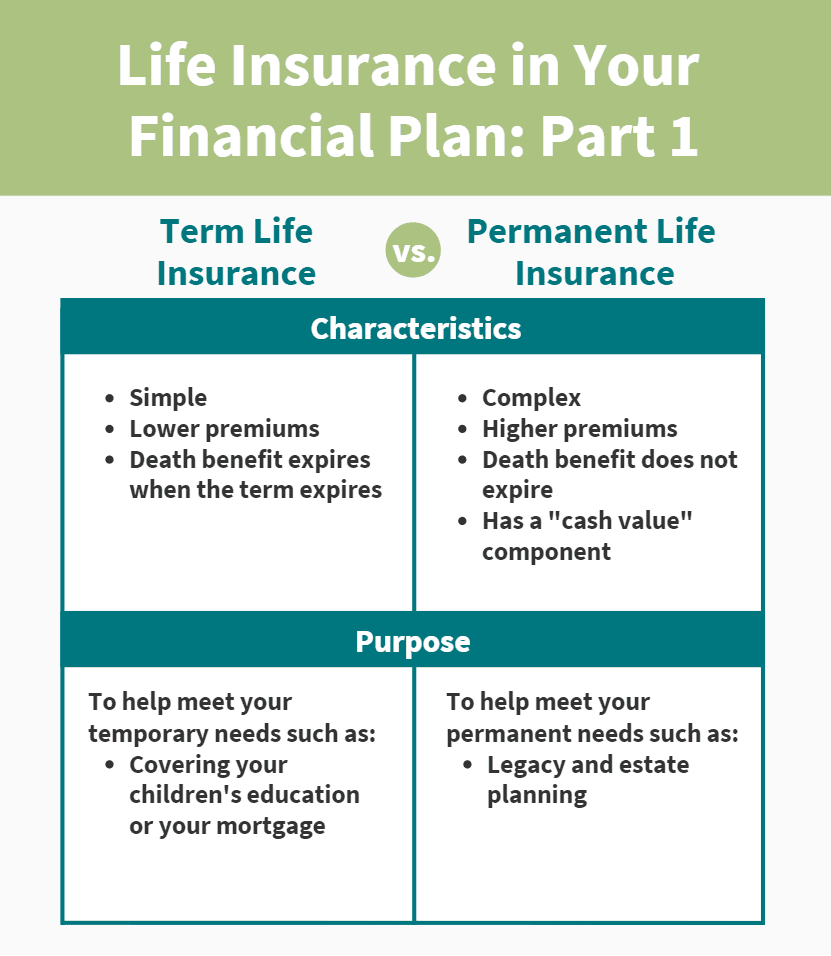

Term Life Insurance

Term insurance is the most simple and inexpensive form of life insurance. The term is a fixed period, say 10 or 20 years, in which you pay your premiums in exchange for death benefit coverage. If you die within the term period the insurance company pays the death benefit to your beneficiary, if you don’t die within the term period the policy expires. A good way to think about term life insurance is by comparing it to your auto insurance. You pay premiums for your auto insurance in case you get into an accident. If you don’t get into an accident, you don’t get the premiums back. This concept is the same for term life insurance. Yes, you never receive a benefit from this policy if the term expires. But hey, at least you’re alive! A few good examples of when term life insurance makes sense are in cases of temporary needs such as:

- Affordable coverage during your earning years

- Covering specific large expenses such as your children’s education or your mortgage

- Covering your funeral costs and other final expenses

Permanent Life Insurance

Permanent insurance, which is much more complex than term insurance, can function not only as an insurance expense but an asset as well. The main differences from term insurance is that permanent insurance has a “cash value” component and the death benefit doesn’t expire. While the premiums are required for the rest of your life, the cash value can help offset some or all of this insurance cost if it has enough time to accumulate. Some examples of when permanent life insurance makes sense are in cases of permanent needs such as:

- Offsetting a decrease in pension income from an early death in retirement

- Legacy planning, transferring wealth across generations

- Estate planning, providing liquidity to an illiquid estate or covering taxes from a sizable estate

There are various forms of permanent life insurance to consider; whole life, universal life, and variable universal life insurance.

Whole Life Insurance

Whole life insurance is considered the “original” permanent life insurance whereby the policy is in place for your entire life. The premiums for a whole life policy are fixed for the entire length of the policy, so as long as they are paid, they will not increase as you age. When paying premiums to your whole life policy, part goes towards covering the actual cost of insurance and part goes into the cash value savings component. This can explain the cost difference when comparing with term insurance!

Universal Life Insurance

Universal life insurance is very similar to Whole Life except that your premiums and death benefit can be more flexible, and you can adjust them if you need to. When adjusting your premiums, you are essentially using some of your cash value to make your payment lower. If an unexpected financial need arises you can temporarily stop your premium payments and make up the difference later when things are back to normal.

Variable Universal Life Insurance

This is where we start seeing much more complexity because in addition to the insurance piece and savings component, variable universal life allows for you to decide how your cash value is invested. While this may seem like a bonus, the investment risk is now completely on you, not the insurance company.

Everyone’s life insurance needs are different, so feel free to reach out us if you have any questions regarding how life insurance could be a piece to your financial plan. This information is not intended to be a substitute for specific individualized advice, and we suggest you discuss your specific situation with a qualified financial advisor.

https://www.bestliferates.org/life-insurance-statistics/

https://www.metlife.com/blog/insurance/life-insurance/

https://www.insure.com/life-insurance/whole-life-basics.html