Please provide your information and submit this form. Our team will be in touch with you shortly.

When considering disability insurance as a part of your financial plan, it can be difficult to imagine and plan for the unknown. You may be wondering what the odds are of becoming disabled and not being able to work, but statistically speaking, disability happens more often than you’d think. Despite what you think your odds are of becoming disabled, there is one thing that you know for sure: if you were to become disabled and not be able to work, you need to replace your income and cover your expenses so that you can take care of yourself and the people that rely on you for support.

In the first of our series on ways to plan for incapacity, we talked about the basics and benefits of including disability insurance in your financial plan. This second series is going to explain a common starting point to estimating your disability insurance needs.

The first step in estimating your disability insurance needs is identifying your sources of income. The income that you earn from work will need to be replaced so that you can maintain the same standard of living you had before becoming disabled. Other sources of income can be used to offset the amount of disability insurance you need, such as your spouse’s income, interest and dividends, and rental income.

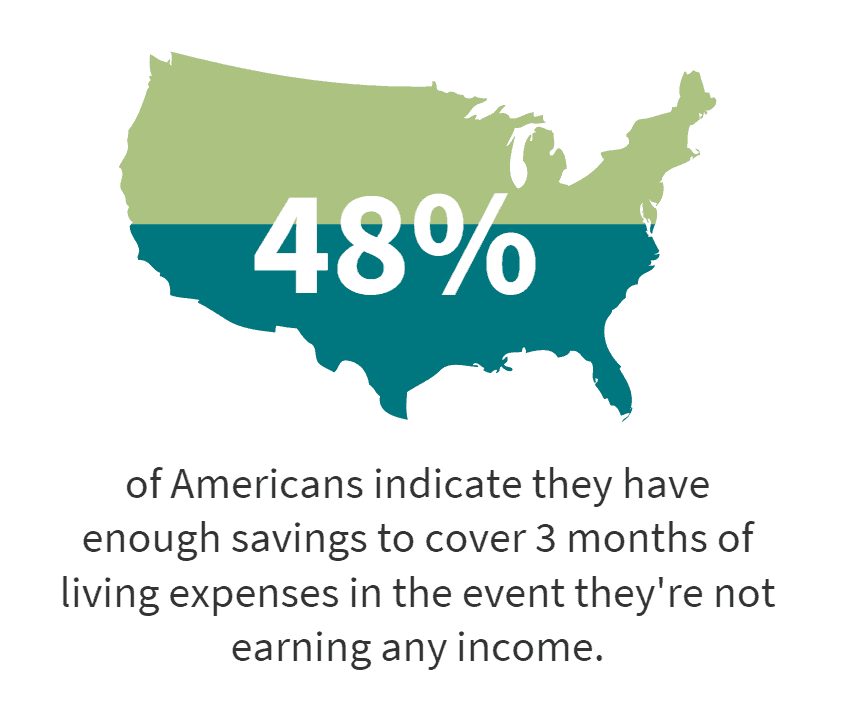

The next step is to determine what your monthly living expenses are. These expenses include your mortgage or rent, utilities, loan repayments, clothing, food and just about every expense you need to continue living your life! Being able to cover these expenses is important not only to maintain the same standard of living, but to maintain your credit score and avoid various penalties and accrued interest for any financial obligations you may have. Another thing to consider is the possibility of large medical bills due to your disability.

While having enough of a disability benefit to cover your living expenses is important, it’s the bare minimum you need. In addition to covering your living expenses, your benefit should be substantial enough to maintain your savings rate so that your retirement goals aren’t compromised.

After getting an idea of how much disability insurance you need, there are some key factors that should be considered. Typically, the maximum amount of disability insurance you can get is 80%, depending on the insurance company and your salary. For those who are younger and have more work ahead of them, getting coverage closer to the higher end would be beneficial.

For those approaching retirement, they generally fall into one of two categories. The first are those that are still working because they have to, making disability insurance just as important as it if for someone who is younger. There are also those that are working not because they need to, but because they want to. Generally, this second category of people already have the assets they need to retire, so their disability benefit can be reduced.

Another consideration is, if your coverage is through your employer, whether your benefit is taxable or nontaxable. If your employer pays the premium, the benefit you receive will be taxable which ends up reducing the amount of benefit you actually get. If you as the employee pays the premium, your benefit will not be taxable.

To get started on calculating your disability insurance needs, try using the disability insurance calculator found in the insurance resources tab.

Everyone’s financial situation is different. Feel free to reach out to us if you have any questions about how disability insurance can be a part of your financial plan. This information is not intended to be a substitute for specific individualized advice, and we suggest you discuss your specific situation with a qualified financial advisor.

https://disabilitycanhappen.org/disability-statistic/

https://www.nolo.com/legal-encyclopedia/how-much-does-long-term-disability-pay.html

https://www.policygenius.com/disability-insurance/how-much-disability-insurance-do-i-need/

https://www.fool.com/personal-finance/2014/05/18/how-much-disability-insurance-do-you-need.aspx