Please provide your information and submit this form. Our team will be in touch with you shortly.

Tax Strategy

Tax Strategy

Understanding tax strategies and managing your tax bill should be part of any sound financial approach. Some taxes can be deferred, and others can be managed through tax-efficient investing. With careful and consistent preparation, you may be able to manage the impact of taxes on your financial efforts.

Listing View:

Your Guide to Inheritance Taxes in 2021

ARTICLE - 1620 Views

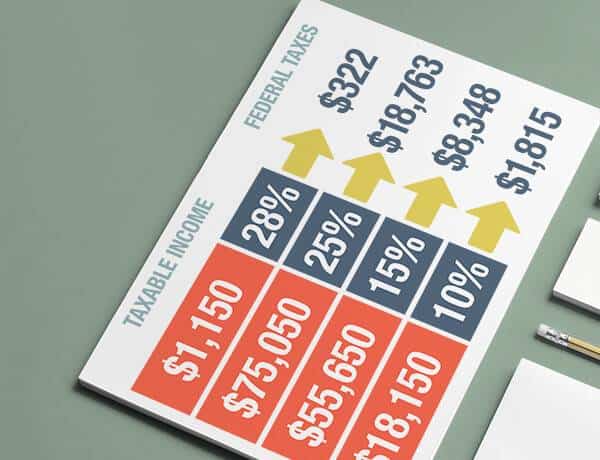

UNDERSTANDING MARGINAL INCOME TAX BRACKETS

ARTICLE - 1404 Views

HOW TO APPEAL YOUR PROPERTY TAXES

ARTICLE - 1213 Views

Providing Care for Aging Parents? Don’t Forget These Tax Breaks

ARTICLE - 1209 Views

WHAT IS A 1035 EXCHANGE?

ARTICLE - 1154 Views

Making Smart Decisions about Your Inheritance

ARTICLE - 1133 Views

WHAT IF YOU GET AUDITED?

ARTICLE - 1050 Views

TAX RULES WHEN SELLING YOUR HOME

ARTICLE - 992 Views

“DIRTY DOZEN” TAX SCAMS TO WATCH FOR

ARTICLE - 991 Views

DO YOU OWE THE AMT?

ARTICLE - 978 Views

WHAT DO YOUR TAXES PAY FOR?

ARTICLE - 974 Views

THE FACTS ABOUT INCOME TAX

VIDEO - 973 Views

HOW INCOME TAXES WORK

ARTICLE - 951 Views

RED FLAGS FOR TAX AUDITORS

ARTICLE - 946 Views

You May Need to Make Estimated Tax Payments If…

ARTICLE - 938 Views

The Benefits of Early Tax Planning

ARTICLE - 937 Views

Tax Tips for Year-End, 2023

ARTICLE - 917 Views

TAX DEDUCTIONS YOU WON’T BELIEVE

ARTICLE - 892 Views

End of the Year Tax Planning for Retirees

ARTICLE - 891 Views

FILING FINAL TAX RETURNS FOR THE DECEASED

ARTICLE - 889 Views

Aspen Tax Strategy

Tax Strategy blogs

FREE CONSULTATION

Need a second opinion on your portfolio?