Please provide your information and submit this form. Our team will be in touch with you shortly.

Retirement Planning

INVESTMENT STRATEGIES FOR RETIREMENT

PRESENTATION

0 out of 21

0 out of 21

You’ve probably given a lot of thought to what your dream retirement will look like. Now it is time to decide how you are going to pay for it. Like the rest of life, retirement doesn’t come with guarantees. But a sound investment strategy is an excellent start toward helping you pursue your retirement goals.

When approaching the retirement years, certain questions take on paramount importance.

First, barring unforeseen circumstances, how long should we expect retirement to last?

Second, how can we potentially determine what this new phase of life may cost?

Third, what sources of income do we anticipate having?

Fourth, what investment strategies can help us pursue the goals we have for our retirement?

Let’s examine these questions one at a time.

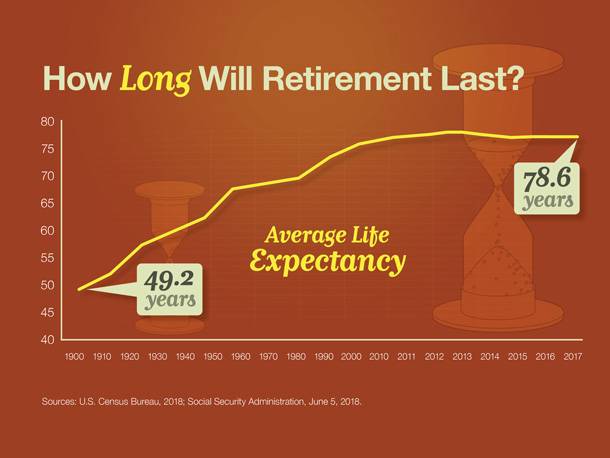

How long will retirement last?

Over the last century, life expectancy has risen dramatically in the U.S. In 1900, the average life expectancy was 49.2 years. Americans had a much higher life expectancy of 78.6 years in 2017, according to the most recent statistics available.

The current retirement age of 65 years was established in the late 1800s and was based, at least in part, on the fact that the average person lived 15 years fewer than that. With all the advances in technology and medicine, it’s possible that many of today’s retirees may live much longer than their ancestors.

One out of three males and one out of two females in their fifties today will live to age 90. For a 65-year-old couple the life expectancy goes up even more. There is a 50% chance that one of them will live to age 92.

Sources: CDC National Center for Health Statistics, 2018; Social Security Administration, 2018; Society of Actuaries, 2018.

Second question: how much is it expected to cost?

You’ve probably seen projections that estimate anywhere from 60% to 90% of your current income may be needed as your retirement income. But this approach, while simple, may give you an unrealistic idea of what you potentially might need. Instead, look at your current expenses and decide which of those are expected to remain after you retire.

It’s important to be realistic about your “basic needs.“ You might not think of listing things like pet care, yard maintenance, and regular visits to salons or spas. But if you enjoy those services now, you may want them during retirement, and you might find that you underestimated the real cost of maintaining your desired lifestyle. In addition, gifts to children and grandchildren — as well as financial help for these dependents — may represent an expenditure during retirement years. All of these “basic needs“ should be accounted for in advance.

Remember, even though you enter a new phase of life, you remain the same person!

In addition, make a realistic assessment of your activities during retirement. What goals or hobbies do you intend to pursue, and how expensive do you anticipate they will be?

Finally, many of us have special circumstances that may require additional resources during retirement, and these must be factored in.

Once you have estimated the income you may need in retirement, you can estimate the cost of the retirement you want.

The next step is to account for other income sources, such as Social Security, IRAs, and any qualified retirement plans. To estimate how much each may potentially provide, take a look at your most recent statement.

With these numbers in hand, estimating any shortfall you may have is a matter of subtraction. That is, subtract the income you anticipate from your estimate from the income you may need in order to maintain the lifestyle you want.

You may want to account for economic factors that can impact your retirement portfolio’s performance. Also, taxes, inflation, and investment risk may have a role to play.

Keep in mind the estimates and guidelines suggested are for informational purposes only and should not be considered a substitute for a more comprehensive review.

What sources of income do you anticipate having?

Traditionally, retirement funding has been viewed as a “three-legged stool,“ implying a balance between Social Security, retirement plans, and savings and investments.

As the baby-boom generation ages, there is a potential that Social Security benefits may decrease—or the age at which an individual can collect benefits may also increase. Changes in employment may affect retirement plans. As a result, the third leg of the stool, savings and investments, may become even more important.

Let’s take a closer look at how the long-term trend of aging may influence Social Security.

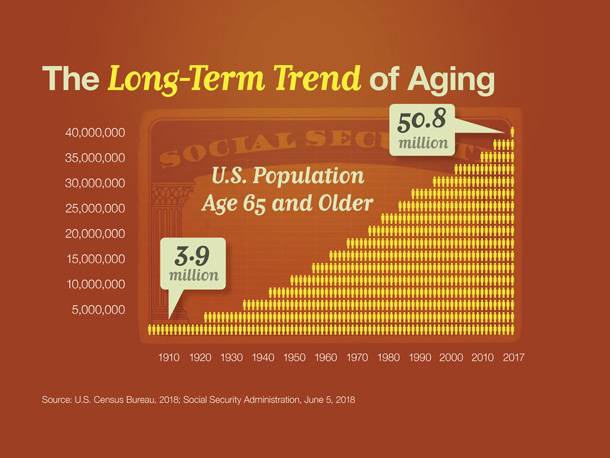

Social Security is facing a major challenge. The number of people who are expected to depend on benefits is increasing as the number of people paying into the system is decreasing. As the chart shows, the over-65 population has been increasing steadily for the past 100 years.

And that upward curve is expected to get a bit steeper now that the baby boomers are entering retirement.

In 2018, the Social Security Administration reported paying out more than it took in for the first time in decades. If no changes are made, the trust fund is expected to be completely exhausted by 2034.

For years, Congress has considered proposals to make changes to Social Security. No one’s certain what Congress may do, but one option could be to raise the age at which retirees become eligible for benefits. Another might be to reduce benefits.

Whatever the case, Social Security may not be able to provide enough to be an individual’s sole source of retirement income.

Sources: U.S. Census Bureau, 2018; Social Security Administration, June 5, 2018

The second leg of that three-legged stool is retirement plans.

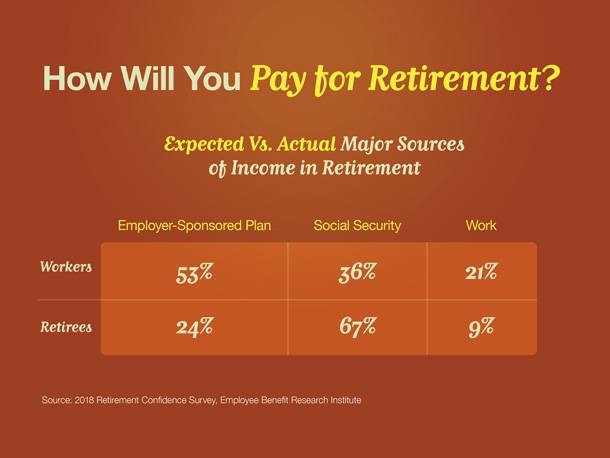

As the chart illustrates, 53% of workers today expect their employer-sponsored retirement plan to be a major source of income in retirement, but only 24% of retirees say that it is.

On the other hand, only about one-third of workers say Social Security will be a major source of income when they retire, but two-thirds of current retirees report that Social Security plays a major role in providing income for them.

Source: 2018 Retirement Confidence Survey, Employee Benefit Research Institute

If the objective is to safeguard principal, a Certificate of Deposit is one option. CDs are insured by the Federal Deposit Insurance Corp up to $250,000. Holding money in a money market fund is another approach. Money market funds are investment funds that seek to preserve the value of your investment at $1.00 a share. However, it is possible to lose money by investing in a money market fund. Individual bonds, income-oriented mutual funds, and fixed annuities can be structured to generate a steady stream of income. Bonds have different maturities and are subject to interest-rate, credit, and inflation risk. When interest rates increase, bond prices generally will fall, which may affect a bond or a bond fund’s performance. Bonds redeemed before maturity may be worth more or less than their original cost. Market conditions will affect the return and principal value of bonds and bond funds. Income-oriented mutual funds may be appropriate for certain types of investors. The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities have fees and charges associated with the contract, and a surrender charge also may apply if the contract owner elects to give up the annuity before certain time-period conditions are satisfied. The earnings component of an annuity withdrawal is taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. A surrender charge may apply if the contract owner gives up the annuity before time-period conditions are satisfied. For growth potential, individual stocks, growth-oriented mutual funds, and variable annuities may be appropriate. Individual stocks will fluctuate in value and, when sold, they may be worth more or less than the initial purchase price. Mutual funds and annuities are sold only by prospectus. You should consider the charges, risks, expenses, and investment objectives carefully before investing or entering a contract. A prospectus containing this and other information about the investment company or insurance company can be obtained from your financial professional. Read it carefully before you invest or send money.

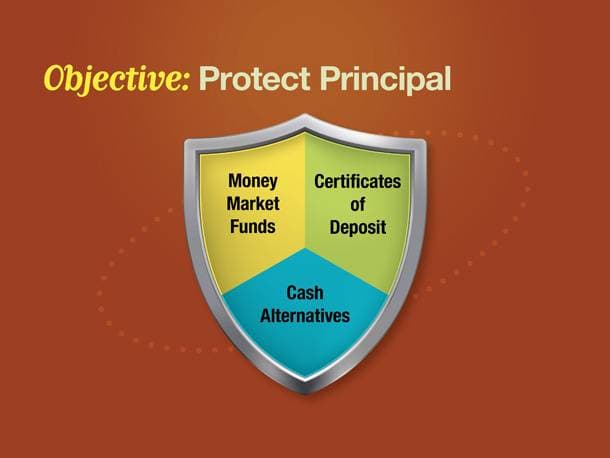

Many investors place a portion of their portfolio in a position designed to protect principal. This is a secure portion that is exposed to little market risk.

Among the more common investments in this class are money market funds, Certificates of Deposit, and U.S Treasury bills, which are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. If a Treasury bill is sold prior to maturity, there is the opportunity for capital loss or capital gain, depending on the interest rate environment.

Keeping too much of a portfolio in secure investments exposes a person to another risk: inflation. Low risk investments tend to generate low rates of return. And over some periods, low-risk, low-return investments may fail to keep pace with inflation.

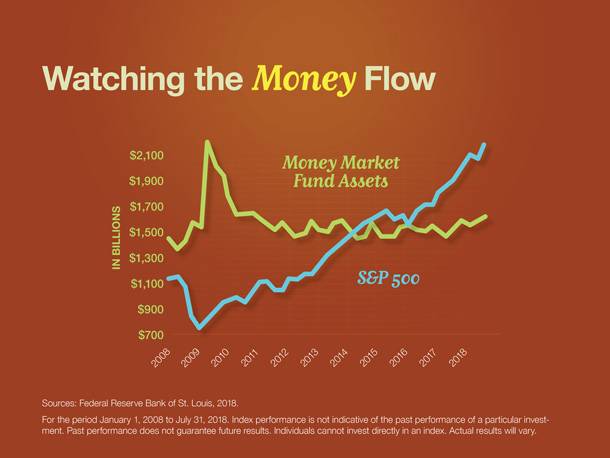

Interestingly, many investors have historically moved in and out of these investments depending on the volatility of the market.

The blue line on this chart shows the performance of the Standard & Poor’s 500 stock index, generally regarded as representative of the U.S. stock market. Beginning in October 2008, the S&P 500 experienced a steep drop that lasted through March 2009. Then stock prices began to recover.

The green line shows the total dollars invested in money market mutual funds. As the chart shows, money kept in money market funds rises in a near mirror image of the S&P 500. As the stock market fell, investors moved more cash into money market funds. Then when the market began to recover, money market fund assets trended lower.

The S&P 500 Composite Index (total return) is an unmanaged index that is generally considered representative of the U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Actual results will vary.

Source: Federal Reserve Bank of St. Louis, 2018

The second investment objective for many retirees is to generate income. Among the more common income-generating investments are individual bonds, income-oriented mutual funds, and fixed annuities.

When considering investments that generate income, it’s important to remember that bond prices rise and fall daily. If a bond is held to maturity, a bondholder will receive the interest payments due plus original principal, barring default by the issuer. A bond fund’s net asset value (NAV) will fluctuate with the price of the underlying bonds in the portfolio. The NAV also may fluctuate as a result of turnover activity. Bond fund shares may lose principal during a period of rising interest rates. Return of principal is not guaranteed.

Generally, annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies). The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities are not guaranteed by the FDIC or any other government agency.

Investing in mutual funds is subject to risk and potential loss of principal. There is no assurance or certainty that any investment or strategy will be successful in meeting its objectives. Investors should consider the investment objectives, risks, charges, and expenses of the fund carefully before investing. The prospectus contains this and other information about the funds. Contact the fund company directly or your financial professional to obtain a prospectus, which should be read carefully before investing or sending money.

The second investment objective for many retirees is to generate income. Among the more common income-generating investments are individual bonds, income-oriented mutual funds, and fixed annuities.

When considering investments that generate income, it’s important to remember that bond prices rise and fall daily. If a bond is held to maturity, a bondholder will receive the interest payments due plus original principal, barring default by the issuer. A bond fund’s net asset value (NAV) will fluctuate with the price of the underlying bonds in the portfolio. The NAV also may fluctuate as a result of turnover activity. Bond fund shares may lose principal during a period of rising interest rates. Return of principal is not guaranteed.

Generally, annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies). The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities are not guaranteed by the FDIC or any other government agency.

Investing in mutual funds is subject to risk and potential loss of principal. There is no assurance or certainty that any investment or strategy will be successful in meeting its objectives. Investors should consider the investment objectives, risks, charges, and expenses of the fund carefully before investing. The prospectus contains this and other information about the funds. Contact the fund company directly or your financial professional to obtain a prospectus, which should be read carefully before investing or sending money.

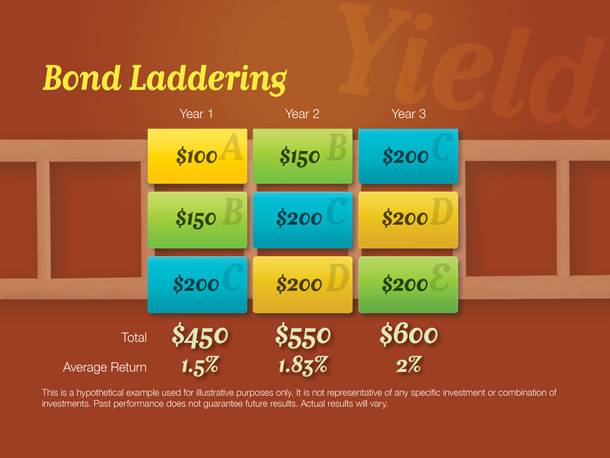

Here’s a closer look at the bond laddering strategy.

In year one, the portfolio had a hypothetical yield of 1.5%. In this hypothetical example, interest rates are rising slightly, which allows the investor to purchase bonds with slightly higher market rates. In year two, the portfolio had a hypothetical yield of 1.83%, and in year three, 2.0%.

This bond-laddering portfolio has been simplified to illustrate the concept. An actual bond laddering strategy may be more complex and involve additional fees and expenses. This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

While bond laddering is appropriate for some investors, others prefer to leave the portfolio strategies to the professionals. They rely on mutual funds that are designed to generate income.

Income-oriented mutual funds focus on generating current income, either on a monthly or quarterly basis. Generating current income is the emphasis, rather than capital appreciation.

Income-oriented mutual funds may be appropriate for certain types of investors. For example, income-oriented investors who are seeking a way to participate in the stock market may be attracted to income-oriented funds. Also, growth-oriented investors who want a fund that has the potential to manage market declines, and long-term investors looking for a core holding, may appreciate what income-oriented funds have to offer.

Some income-oriented funds can invest in a wide-range of investment options. Others are more limited in the securities they can choose from. A review of your personal situation may help determine whether an income-oriented fund is appropriate.

Investing in mutual funds is subject to risk and potential loss of principal. There is no assurance or certainty that any investment or strategy will be successful in meeting its objectives. Investors should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus contains this and other information about the funds. Contact the fund company directly or your financial professional to obtain a prospectus, which should be read carefully before investing or sending money.

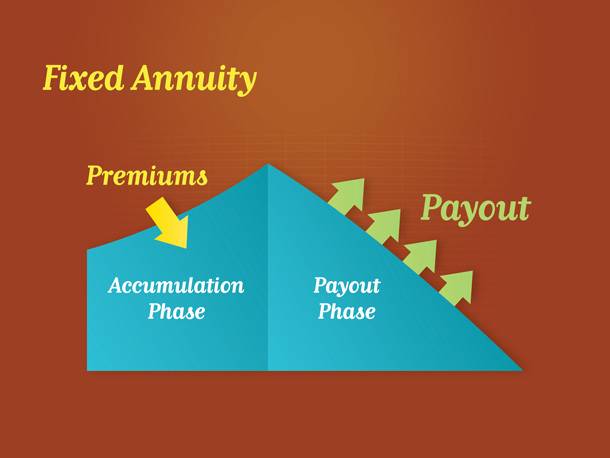

Another income generation tool is a fixed-annuity contract. Fixed annuities are interest-based vehicles that are similar to bank-issued CDs, but geared specifically towards retirement savings. In this example, the fixed annuity has an accumulation phase, where the annuity contract grows tax deferred. Next, the fixed annuity enters a payout phase, where the contract holder collects income. Fixed annuities are considered low risk and potentially can offer slightly higher returns than cash vehicles.

Annuity contracts are purchased from an insurance company. Fixed annuities offer some protection against market risk. Fixed annuities can be structured to offer a guaranteed source of regular income for a fixed term or for a person’s lifetime.

The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities have fees and charges associated with the contract, and a surrender charge also may apply if the contract owner elects to give up the annuity before certain time-period conditions are satisfied. The earnings component of an annuity withdrawal is taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Annuities are not guaranteed by the FDIC or any other government agency.

You also may want to consider investing a portion of your retirement portfolio for growth.

Among the more common investments in this class are individual stocks, growth-oriented mutual funds, and variable annuities.

When considering growth investments, it’s important to understand what determines a portfolio’s overall return.

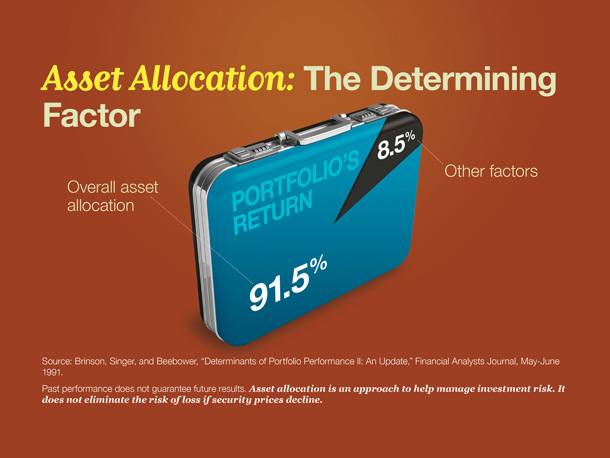

A landmark study found that 91.5% of a portfolio’s return is a result of its overall asset allocation. That far outweighs any other factors—including selection of specific investments.

That means it’s far more important to develop a sound investment strategy than to pick individual stocks. It’s far more important to invest in a mix of asset classes that are consistent with your strategy. However, past performance does not guarantee future results. And asset allocation is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

Source: Brinson, Singer, and Beebower, “Determinants of Portfolio Performance II: An Update,“ Financial Analysts Journal, May-June 1991.

In this hypothetical example, an aggressive portfolio allocated 80% of its assets to stocks, with another 10% in cash and 10% in bonds.

The hypothetical conservative portfolio had only 60% in cash with the remainder divided between stocks and bonds—20% each.

Over the past 20 years, the aggressive portfolio was volatile. In its best year, it returned 24.3%; in its worst it lost -29.3%. Overall, it averaged a 6.2% annual rate of return for the period.

In its best year, the conservative portfolio returned 8.1%; in its worst, it lost -7.1%. And over 20 years, it averaged a 3.7% annual rate of return.

So what’s better? That depends on your individual situation. However, the difference between a 6.2% return and a 3.7% return can add up over time.

Stocks are represented by the S&P 500 Composite Index (total return), an unmanaged index that is generally considered representative of the U.S. stock market. Bonds are represented by the Citigroup Corporate Bond Composite Index, an unmanaged index that is generally considered representative of the U.S. bond market. Cash is represented by the Citigroup 3-Month Treasury-Bill Index, an unmanaged index that is generally considered representative of the U.S. cash market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index.

Source: Thomson Reuters, 2019

The difference between the conservative portfolio and the aggressive portfolio was roughly 2.5%.

In this example, one $100,000 portfolio generated a hypothetical 6.2%, while another generated a 3.7% return over 20 years. At the end of the period, the portfolio that produced the hypothetical 6.2% annual rate of return was worth $281,729. The portfolio that produced the hypothetical 3.7% annual rate of return was worth $202,915.

That’s an $80,000 difference.

Past performance does not guarantee future results. Actual results will vary.

Developing an investment plan is a vital step in pursuit of your retirement goals. Here are some scenarios that might be familiar to you:

Anthony and Selena have a variety of investments with a few different brokerage firms. They want to know, “Are our investments balanced in a way that is appropriate for our life stage and goals? What is our overall return on our investments, and how do we know if we need to make some changes?”

Rebecca is a single business owner nearing retirement. She wonders, “Will my retirement plan provide enough income, along with Social Security and savings, to meet my needs? How shall I pass my business along when I retire?”

Dave and Christine have grown children whom they help financially, and they care for a parent. They want to know, “How should we best allocate our assets to provide enough income for our various dependents? Are there investment options that may help us defer taxes until we reach a lower income bracket?”

Isaac likes to invest in individual stocks and bonds, after researching them online and watching reports on television. He asks, “How are my individual stock and bond investments measuring up in comparison with the managed funds? Will the return on my investment portfolio outpace inflation?”

The answer to these and other concerns will vary with each individual situation and can all be addressed in a review.