Please provide your information and submit this form. Our team will be in touch with you shortly.

Money

Your Cash Flow Statement

PRESENTATION

0 out of 17

0 out of 17

Understanding money matters and managing your cash flow are an integral part of any sound financial management strategy. Effectively managing your cash flow can free up capital to save and invest—assets you can put to work—helping you pursue your financial goals.

It’s made of simple linen and cotton paper, it doesn’t weigh much or take up much space, but printed money is a major part of our lives.

In 2019, the Bureau of Engraving and Printing printed roughly 7 billion pieces of paper currency with a face value of $206.9 billion. How much of that money is going into your savings and investments? Money is one of the things we think about every day, even many times a day. But while we may think about it, talk about it, and worry about it, we sometimes fail to take the time to manage our cash effectively.

Every successful investor knows that management of cash assets is key to a sound strategy. To begin with, you’ll want to understand how time may influence your ability to reach your goals. Next you’ll also want to take a look at your financial profile and examine your credit standing, your cash holdings, and whether it is time to rebalance your cash portfolio.

Source: U.S. Bureau of Engraving and Printing, 2018; Federal Reserve August 9, 2018

Once you understand the role time plays in your long-term investment outlook, you can be better prepared to make wise decisions when it comes to cash management.

Having a good handle on how your credit score can affect your purchasing power could also help. There can be a correlation between your credit score and the rates you may be charged for any type of installment debt. And a higher credit score has the potential to add up to real savings over time.

In one example, let’s consider a $400,000 loan with a 30-year fixed-rate mortgage. An individual with a credit score of 620 would qualify for a mortgage interest rate of 5.83%. At that rate, the mortgage may carry a monthly payment of $2,354.

Let’s see what may happen if the person’s credit score is above 760. With that credit score, the individual would qualify for a 30-year fixed-rate mortgage with an interest rate of 4.24%. The monthly payment would be $1,966. That’s a difference of nearly $388 per month, or over $4,600 per year.

Over the life of that mortgage, that difference adds up to nearly $140,000—more than a third of the cost of the home. Just because of a credit score.

One of the goals of a sound financial strategy is to find the appropriate mix of investments. At the bottom of our illustration are cash alternatives, which have low risk but also offer the lowest potential return. As you move higher up the illustration, each section represents the opportunity for higher potential return, but also carries higher risk.

The reason why cash alternatives are at the foundation of a well-balanced portfolio is that cash alternatives allow you to meet short-term and unpredictable expenses. Having cash and cash alternatives also may allow you to manage other investments—rather than selling at what could be an inopportune time.

Keep in mind that allocating your assets among different investments is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.

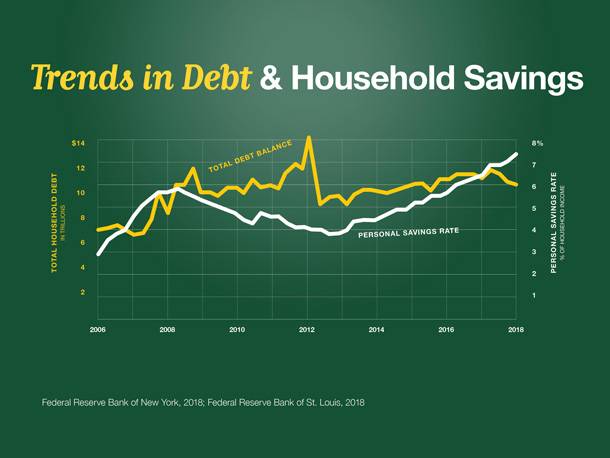

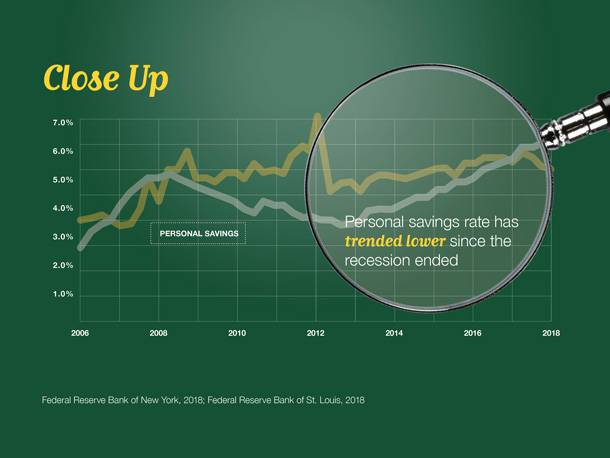

One effect of the financial crisis of 2008-2009 was that Americans broke a long-term trend of low personal savings and increased the amount of money they saved.

As the chart illustrates, total household debt rose continuously from 2006 until it hit a high 2008.

During that time of financial turmoil, the personal savings rate—as measured by the Federal Reserve—started to climb steadily. In 2012, personal savings reached over 9% of disposable household income. Later, as the economic recovery gained some momentum, personal savings once again slowed while household debt climbed to new levels.

Sources: Federal Reserve Bank of New York, 2018; Federal Reserve Bank of St. Louis, 2018

A closer look at the chart shows that, though America’s personal savings rate climbed higher during the recession, the rate of savings growth in the U.S. has slowed as the economic environment has improved. Meanwhile debt has steadily risen.

This pattern of spending during good times and saving during bad times is understandable, but a better approach is a steady, consistent program of saving.

Sources: Federal Reserve Bank of New York, 2018; Federal Reserve Bank of St. Louis, 2018

For that portion of a portfolio that must be liquid, most investors consider one or more of four places. Each has drawbacks and advantages.

Traditional bank savings accounts (savings, checking) are both guaranteed, up to certain limits, by the FDIC. However, traditional bank account returns are modest at best.

Certificates of deposit, on the other hand, are time deposits offered by banks, thrift institutions, and credit unions. They may offer a slightly higher return than a traditional bank savings account, but they also may require a higher amount of deposit. If you sell before the CD reaches maturity, you may be subject to penalties.

Bank savings accounts and CDs are FDIC insured up to $250,000 per depositor, per institution and generally provide a fixed return, whereas the value of money market funds can fluctuate.

Money market funds are investment funds that seek to preserve the value of your investment at $1.00 a share. Money held in money market funds is not insured or guaranteed by the FDIC or any other government agency. It’s possible to lose money by investing in a money market fund. Mutual funds are sold by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from your financial professional. Read it carefully before you invest or send money.

Treasury bills are actually debt-based instruments—investors lend money to the U.S. government and are paid a specific rate of return. Treasury bills are backed by the full faith and credit of the federal government as to the timely payment of principal and interest. If a Treasury bill is sold prior to maturity, there is the opportunity for a capital loss or gain, depending on the interest rate environment.

Cash alternatives offer low risk, low potential returns; each of these investments may be vulnerable to taxes and inflation.

It works like this.

Let’s assume you invested $10,000 in a CD earning 1%. After one year, your account would be worth $10,100. After taxes on the interest are paid, the account would be worth $10,078.

Then you need to account for the effects of inflation. Assuming a 3% rate of inflation, the account value would actually be the equivalent of $9,776.

If you aren’t careful, you can actually lose purchasing power with your low-risk, low-potential-return investments. This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

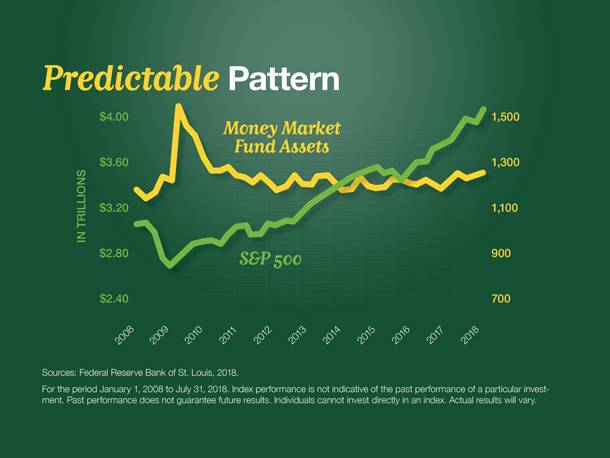

Interestingly, many investors move in and out of cash alternatives depending on the volatility of the market.

This chart shows the pattern that unfolded in the wake of the recession that began in 2008. The yellow line on this chart shows the performance of the Standard & Poor’s 500 stock index, generally regarded as representative of the U.S. stock market. Beginning in mid-2008, the markets experienced a steep drop that lasted right through to March 2009. The market then began a slow and steady advance.

The green line shows the total funds invested in money market mutual funds—one of the cash alternatives we’re talking about. As you can see, it rises in a near mirror-image of the stock market line. That means as the market crashed, investors moved their capital out of stocks and into money market funds. Then when the market began to recover, they slowly began moving back.

Though this response to financial instability is understandable, it is driven by emotion and may not benefit the investor. A better approach to consider is to have adequate savings on hand at all times and to consider investing the surplus in a balanced portfolio for the long-term. Money held in money market funds is not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it is possible to lose money by investing in a money market fund. The Standard & Poor’s 500 Composite Index (total return) is an unmanaged index that is generally considered representative of the U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Actual results will vary.

Sources: Investment Company Institute, 2015; Thomson Reuters, 2015.

At any stage in life, it is wise to reserve enough cash on hand to cover your expenses in three areas:

First, you should be able to replace your income for a short period of time in the event of job loss or a loss of investment income. A good rule of thumb is to have enough on hand to replace your income for three to six months. Or consider setting aside a fixed dollar amount, based on your individual situation.

Second, you should make allowance for emergencies that may occur, such as a catastrophic illness or an accident.

And third, you should have some cash on hand for upcoming large expenses, such as a wedding or an extended vacation.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

It would be nice if we could fill out a simple form and determine how much in savings is right for everyone. But each situation is unique, and you may have special considerations that will affect your savings portfolio. After you have made a list of your outgoing expenditures and then narrowed that list down to those that are absolutely necessary, you will have a starting figure for your savings. Then ask yourself the following questions.

First, how many sources of income does our family have? If you are a two-income family, the chances that both of you will lose your source of income is less than if you are a one-income household. Next, are you paying off some debt? If so, you may want to keep a lower amount in your emergency fund and work to pay down that debt first. Next, do you have special circumstances that require extra cash in emergencies? For example a dependent parent or a child with health concerns may require additional emergency reserves.

The liquidity of your investments can affect your savings portfolio. If you have investments that are easily accessible, you may need less in your savings portfolio. If, on the other hand, most or all of your investments have little or no liquidity, your savings portfolio should be adequate to meet your needs, perhaps for a longer period of time. Finally, examine your own comfort level. For some people, that may require a larger dollar amount than for others.

Finally, you should consider the cost of traditional savings.

For example, some investors who bought 3-year Treasury bills in 2009, when they were yielding only 0.15% may have actually lost money to inflation. This graph shows the historically low rate of return offered by 3-year Treasuries between 2009 and 2012. Since then, they have rebounded, but only slightly.

These low rates of return have caused some investors to reexamine cash alternatives and allocate more cash to higher risk investments with a higher potential rate of return.

The market value of a bond will fluctuate with changes in interest rates. As rates rise, the value of existing bonds typically falls. If an investor sells a bond before maturity, it may be worth more or less than the initial purchase price. By holding a bond to maturity, an investor will receive the interest payments due, plus their original principal, barring default by the issuer. Investments seeking to achieve higher yields also involve a higher degree of risk.

Source: Thomson Reuters, 2019.

It is important not to confuse savings with investments. Many people do this without realizing it.

Savings should be in cash and cash alternatives, which are considered safe, liquid, and easily accessible for emergencies.

An investor’s portfolio should be balanced in order to receive the best possible return with the lowest possible risk.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.

In this illustration, an investor may have too large of a portion of his or her assets in cash alternatives.

The money is in low risk, low return investments, however that money is not safe from taxes and inflation. These factors cause some investors to reconsider their mix of investments; that is, some investors may want to pursue investments that have higher risk with the potential for higher return.

One of these options may include a fixed-interest investment. A fixed-interest investment may have penalties for early withdrawals and other restrictions, so it is important to have adequate savings on the foundation level.

This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.

Without a definite plan, it is easy to let emotion cause us to “jump“ to higher risk and higher potential return.

Ron and Susan have $150,000 in CDs. As these reach maturity, they decide to take $100,000 and divide it between three stocks, looking for higher potential returns but perhaps not understanding the higher risk involved with stock-related investments. Ron and Susan need to understand that past performance does not guarantee future results.

Cash alternatives, fixed interest, bonds, and stocks can be important parts of a balanced portfolio. But before you “jump,” consider your individual situation and understand the risks.

This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.

In another example, Bob and Lydia have $150,000 in savings invested in a CD.

When the CD matures, they sit down with an investment professional and calculate their savings needs.

They find that a savings portfolio of $75,000 is adequate to meet their income needs in case of an emergency. After some consultation they decide to place the remaining $75,000 in a fixed-interest investment.

This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.

Taking control of your money is a life-long process. Here are some questions that arise at different stages in life:

Anthony and Selena, a two-income couple with school-age children, ask, “How much money do we need in savings to safeguard our current lifestyle?”

Dave and Christine, a couple nearing retirement, want to know, “Is there a better place than a savings account to keep our reserve? What should we do when our CD matures?”

Rebecca is a single parent and small business owner. She asks, “How much investment liquidity do I need in order to protect my interests?”

Isaac likes to do research online. He asks, “In an environment of low interest rates, should I be taking more risk?”

The answers to these, and other concerns, will vary with each individual situation, and can all be addressed in a review.

The FDIC insures bank accounts up to $250,000 per depositor per institution in principal and interest. However, other cash alternatives, such as money market funds, are not insured or guaranteed by the FDIC or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it’s possible to lose money by investing in a money market fund or other cash alternative.

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from a financial professional. Read it carefully before you invest or send money.