Please provide your information and submit this form. Our team will be in touch with you shortly.

In the first two series on ways to plan for incapacity, we talked about how disability insurance can be an important piece to your financial plan. The purpose of disability insurance is to replace your income for you and your dependents if you become disabled and can’t work. Disability can range from mental illness to physical injury, and depending on the type of policy you get, you can be covered even if you can’t ever go back to work.

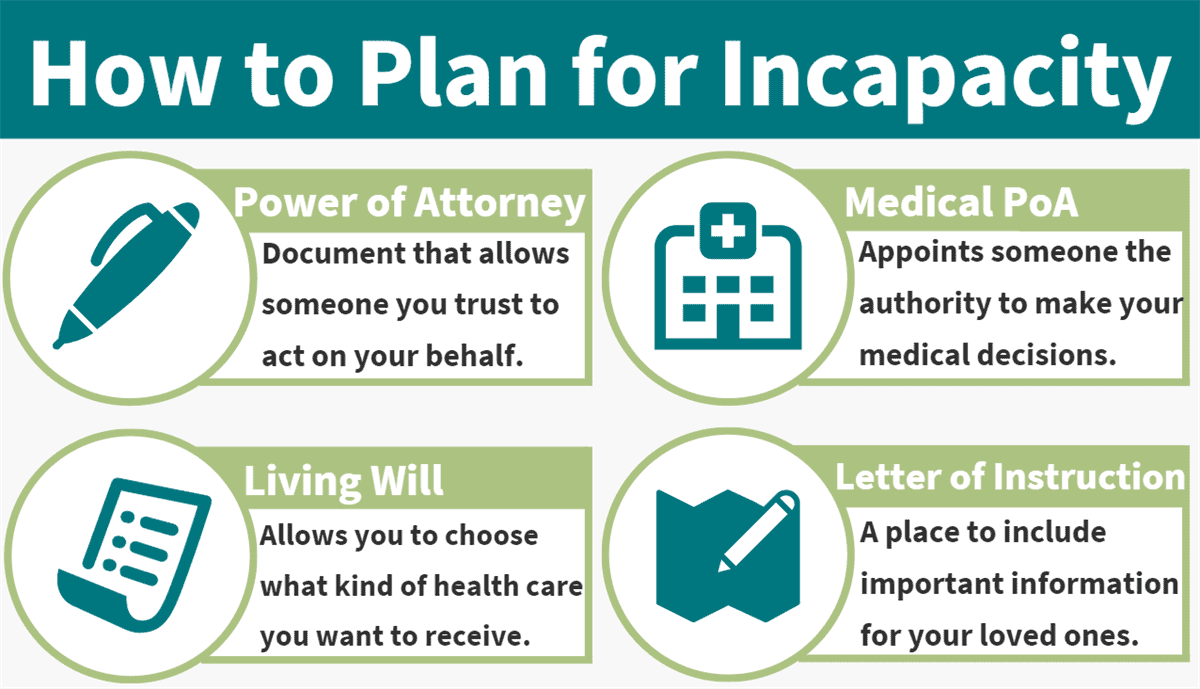

In this series on other ways to plan for incapacity, we are going to look at some important documents to have in place in case you do become so incapacitated that not only are you unable to work, but you can’t make decisions for yourself. Four important documents to have in these situations include:

- Power of Attorney

- Medical Power of Attorney

- Advanced Medical Directive

- Letter of Instruction

If you were to become incapacitated, who is going to handle your financial matters? You can appoint someone you trust ahead of time to take on this financial responsibility. This is called a Power of Attorney, and this document allows someone you trust to act on your behalf. Not only can you control how much power this person has, but you can control when this power will come into play. For example, if you want this authority to come into play only when a specific event occurs such as incapacity, you can make the power “springing.” On the other hand, if you want this power to continue until your death, you can make the power “durable.”

Like granting someone the authority to act on your behalf for financial matters, you can grant someone the authority to act on your behalf in a medical context. A Medical Power of Attorney comes into play when you are unable to make medical decisions for yourself, and this person can make decisions for you regarding medical treatment. Usually this person is someone such as your spouse or close family member.

Another medical document that is important to have is an Advanced Medical Directive, otherwise known as a Living Will. This document allows for you to direct what kind of health care you want ahead of time. For example, if you are on life support, an advanced medical directive lists your wishes as to whether you want to continue life support or not. This document also allows for you to remove the responsibility of making these decisions from your loved ones by stating your wishes ahead of time.

The final estate planning document to have in place is a Letter of Instruction. In this letter, you can include important information that only you know; passwords, where things are kept, and important contact information. By doing this, you are saving your loved ones a lot of time and expense because you are consolidating all your information ahead of time. This document is simple to create and does not have to be witnessed or notarized.

Everyone’s financial situation is different. This information is not intended to be a substitute for specific individualized legal advice, and we suggest you discuss your specific situation with a qualified legal advisor. As always, feel free to contact us with any questions as to how these issues may fit into your overall financial plan!

https://www.caregiver.org/legal-planning-incapacity

https://www.mayoclinic.org/healthy-lifestyle/consumer-health/in-depth/living-wills/art-20046303