Please provide your information and submit this form. Our team will be in touch with you shortly.

Some investors may have felt a strong sense of déjà vu while watching the latest installment of the debt ceiling drama unfold in Washington, DC over the last several weeks. The markets were certainly paying attention; with the closer approach of Treasury Secretary Yellen’s “X-date”—the deadline when the government would run out of money to pay its bills—and no agreement in place, markets began to react negatively as they priced in the potential ramifications of a US debt default. Then, when a compromise was reached and a deal was announced, markets seemed to breathe a sigh of relief, with the S&P 500 rising nearly 4% in the days following the announcement. On June 3, President Biden signed the legislation that will allow the government to continue paying its bills on time.

The last time we had similar “last-minute” drama around the debt ceiling was in 2011, when, as recently, the partisan tug-of-war continued close to the deadline, prompting credit rating agency Standard & Poor’s to downgrade US sovereign debt for the first time in history, from AAA (outstanding) to AA+ (excellent). The debt limit has been increased 79 times (including the latest instance) since 1960, but in recent years, this formerly routine legislation has become an occasion for the two parties in Congress to make statements and draw lines in the sand about government spending and the federal budget.

But what does all this mean for investors?

The debt ceiling functions in similar ways to a US government “credit card”; it allows the government to borrow—in the form of issuing US Treasury securities—to pay the obligations authorized by Congress. The main difference is that the government is both the “card issuer” and the “card user.” Because the US is generally regarded as the world’s most dependable borrower, any tremors in its credit standing will have worldwide ramifications, including market nervousness like that exhibited in the last few weeks.

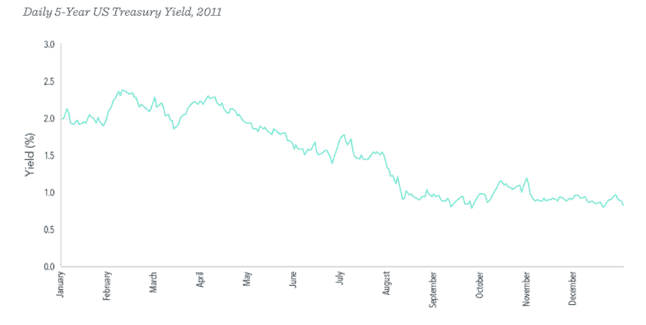

But investors should remember that the debt limit is just one of many factors, both political and economic, that impact market pricing, both for equities (stocks) and fixed income (debt). And the markets may not always react as anticipated. For example, during the 2011 debt ceiling crisis, Treasury yields actually declined fairly steadily in the month preceding Congress’s agreement to raise the limit and continued dropping even after the credit downgrade by Standard & Poor’s on August 6, 2011 (bond yields and bond prices move inversely; when yields drop, prices rise).

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results.

These and other data suggest that trying to anticipate the direction of the markets, even in the face of potentially disruptive events, is a very uncertain undertaking. For one thing, it is unclear what the ultimate economic and fiscal effects would be, even if the government were to default. For another, investors should remember that today’s computer-driven, interconnected financial markets are constantly pricing in the implications of emerging information, millions of times per second. For any single individual to think that they can “out-guess” the cumulative effect of every buying and selling decision being made everywhere around the world is a belief based on something other than fact.

Instead, investors are generally better off when they stick to a sound investment plan that accurately reflects their stage in life, their goals, and their risk tolerance. After all, risk—whether generated by political circumstances, economic cycles, or world events—is part of investing. Investors who understand and accept the necessity of assuming an appropriate degree of risk to achieve desired returns over the long haul can stay focused on long-term goals without allowing short-term volatility to distract them or derail their progress.

At Aspen Wealth Management, we help clients build diversified portfolios designed according to their individual goals. To learn more, read our article, “Five Financial Adages for Thriving in Volatile Markets.”

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information has been derived from sources believed to be accurate and is intended merely for educational purposes, not as advice.