Please provide your information and submit this form. Our team will be in touch with you shortly.

The pandemic (aka COVID-19) is here and we’ve found ourselves socially isolating and in search of a good supply of toilet paper.

When markets fall as rapidly as they have over the last few weeks and the country is going into lock down, it’s reasonable to be worried and even frightened about a situation that seems unprecedented. However, this is not a time to panic because we’ve been here before.

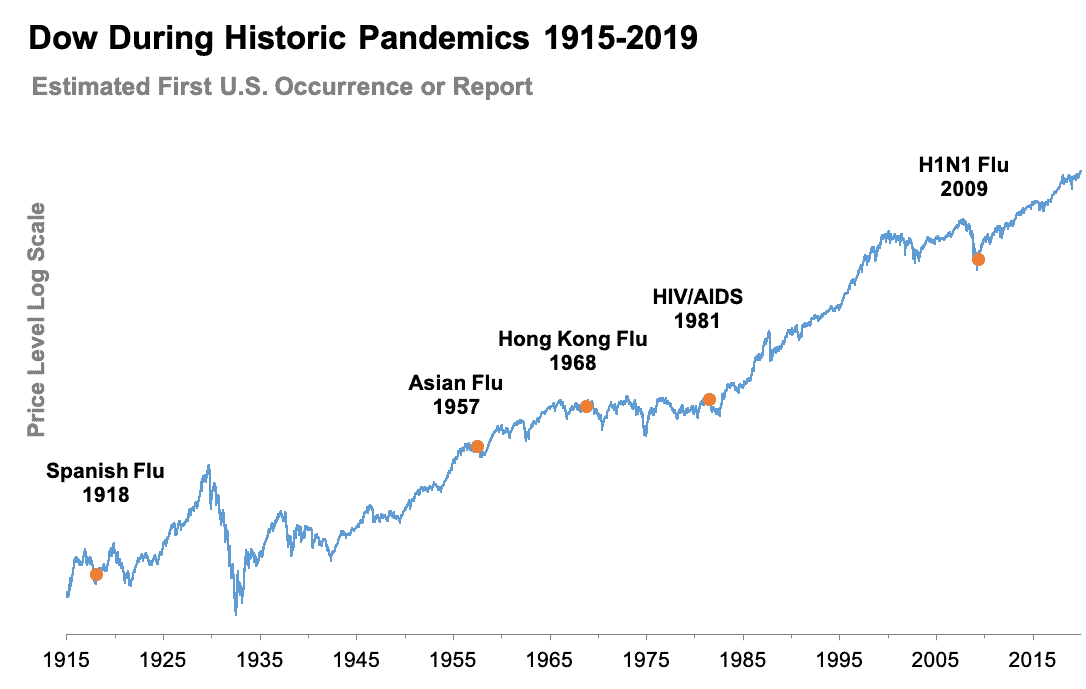

The last outbreak to achieve pandemic status was the H1N1 Swine flu, which hit U.S. soil in April 2009.1 You might hardly remember it because markets were on a tear after bottoming out in March 2009 and the outbreak barely registered on investors.

Some say that COVID-19 is nothing like recent epidemics. So, let’s take a look at one of history’s worst pandemics: The 1918 Spanish Flu. Nearly one-third of the world’s population contracted the disease and more than 50 million died in just 15 months.2 The Spanish Flu led to quarantines, labor shortages, and contributed to a short recession in the aftermath of WWI.3 But, while markets were extremely volatile during 1918, they returned to an upward trajectory by early 1919 before the pandemic was officially over.

History shows us that pandemics are not that uncommon, and their effect on markets is typically short-lived.

Chart source: MacroTrends, CDC

Historically, pandemics have struck the U.S. regularly over the last 100 years. Though outbreaks sometimes precipitated or accompanied market declines, stocks typically regained ground quickly as the epidemic subsided.

The past can’t predict the future, but it’s a good reminder that pandemics are not the only driver of market movements. Economic fundamentals, business health, and future earnings all drive long-term market trends.

Our goal isn’t to downplay the seriousness of the outbreak. We are in the exponential growth period of the virus and it’s not going away soon. However, markets are running on fear and uncertainty more than rational assessments of the future. We have abundant faith in our biotech industry and its ability to find a vaccine.

What should you do right now?

- Don’t buy or sell based on headlines. There’s a lot of fear, speculation, and uncertainty feeding market volatility. Constant news headlines also add to our increasing anxiety!

- Focus on staying healthy and taking sensible precautions to keep yourself and your family safe, especially if you have loved ones who are at higher risk of complications from the virus.

- Show the people around you some extra kindness in these days of anxiety. Let’s be grateful for the medical professionals on the front lines and the hard-working folks keeping stores stocked.

- Remember that we as a nation have been here before, and we have the resources we need to get through this.

- Event driven bear markets in history have lasted 9-12 months.

- While the markets are frightening with their crazy swings, this does pass! This marks the beginning of a new economic cycle!

- If you have ever considered (or your plan has a strategy of) converting a portion of your traditional IRA to a Roth IRA– now is the time. Historically markets have returned after a decline within 6 to 18 months. If it is not too difficult to remember – think about what happened in 2008. If you convert your IRA now you will pay ordinary income tax on the current market value. And when the market rebounds, like it always does, all gains will come to you tax free. No RMDs, which may lower your tax liability and lower Medicare Part B premiums.

We’re watching markets so you don’t have to.

When markets fall off a cliff and economic upheaval is on the horizon, professional advice is one of the best tools you can have to cut through the noise and make rational decisions.

Now is the time for opportunity in the market. “The stock market is a device to transfer money from the impatient to the patient.”- Warren Buffet

Like we’ve communicated before, we are currently conducting business as usual – however we have a plan in place should any of us be compromised in any way. If you prefer to have your appointments over the phone or through video conferencing, we will be happy to accommodate you.

If you need a pep talk or to discuss your investment strategy, please reach out by phone to (817) 546-6353. We’re here to see you through this!

1https://www.cdc.gov/flu/pandemic-resources/2009-h1n1-pandemic.html

2https://www.smithsonianmag.com/history/journal-plague-year-180965222/

3https://www.smithsonianmag.com/history/how-1918-flu-pandemic-helped-advance-womens-rights-180968311/