Please provide your information and submit this form. Our team will be in touch with you shortly.

What is a Recession?

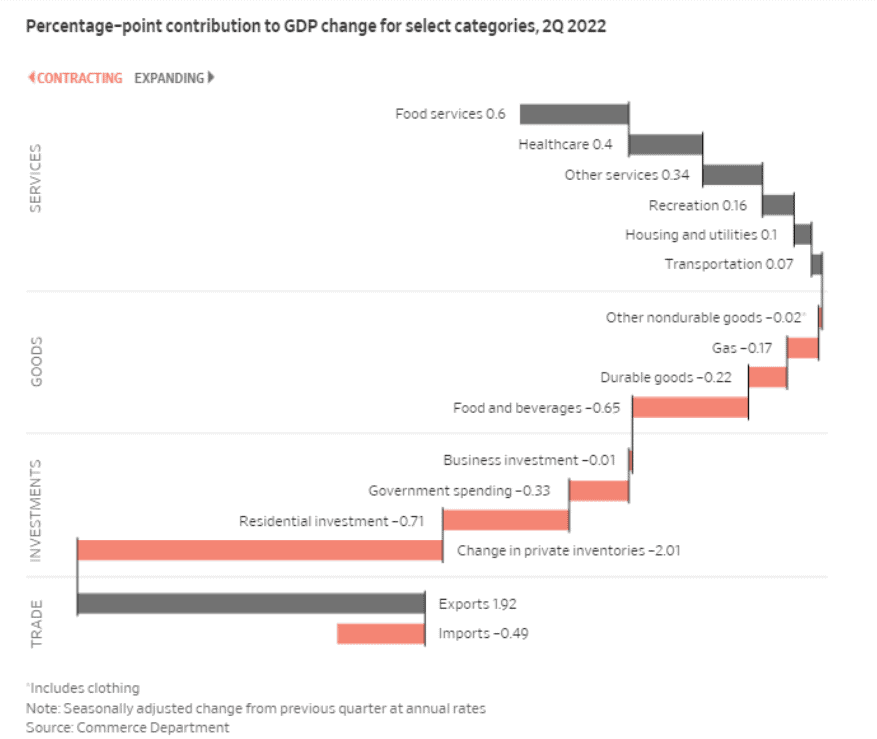

The Commerce Department reported Thursday that based on initial estimates, U.S. GDP (Gross Domestic Product) fell at a 0.9% annualized rate in Q2, now the second consecutive drop following the 1.6% contraction that was reported for Q1.

At its most basic level, the determination of whether the US economy has entered a recession requires no more information. A Recession is commonly defined as two consecutive quarters of declining economic activity as measured by GDP.

The Bureau of Economic Activity, an agency of the Commerce Department, defines GDP as the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production. GDP is also equal to the sum of personal consumption expenditures (food, housing, energy, etc.), gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment.

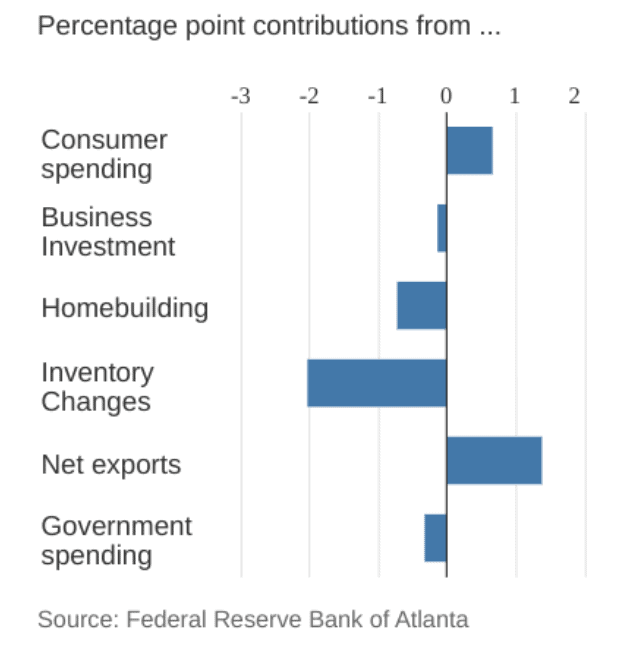

In Q2 the largest detractor from growth was inventory changes:

Businesses stocked up on supply aggressively at the end of 2021 over both fear of supply chain constraints and optimism for increased consumer spending. With some supply chain issues resolving and consumer spending increasing at a slower rate, many businesses are overstocked and filling orders out of existing inventories.

A reduction in home building due to higher costs from higher rates and a decrease in government spending as pandemic-related stimulus continues to unwind rounded out the recessionary contributing factors.

So, after two consecutive quarters of declining GDP why is it even up for debate if our economy is in a recession?

It’s because the official declaration falls to an academic group called the National Bureau of Economic Research (NBER) and they view a decline in output as only one of many factors in defining a recession. They also factor in employment, household income, consumer spending, retail sales, and industrial production. To further complicate things, a “modest” decline in GDP over two quarters likely doesn’t meet their definition as they only consider “significant” declines in GDP to apply.

This is what creates the current confusion around declaring a recession today.

The unemployment rate has held steady at 3.6% and it is estimated that 5.5 million more jobs are available than there are workers to fill them.

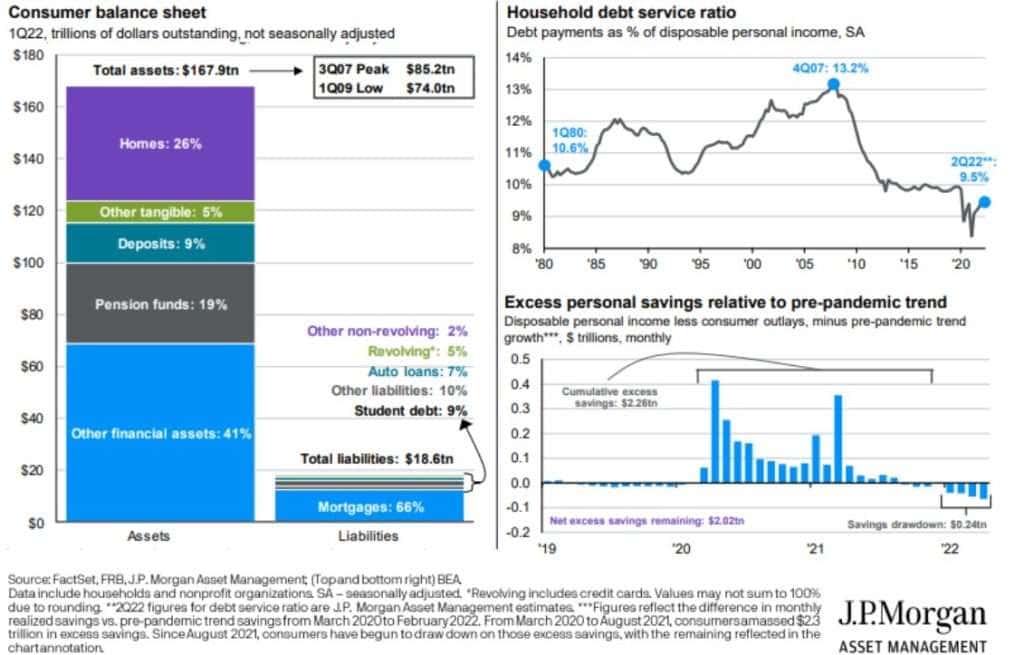

On average, Americans still have extremely healthy balance sheets and a low percentage of disposable income going towards debt payments.

Ultimately, the title we put on the current economic environment doesn’t matter. Public markets function off all cumulative data and the GDP numbers, employment numbers, spending numbers, persistent inflation, and rising rate environment all affect investment portfolios more than whether everyone agrees on the definition of a recession. It is still clear that growth has slowed and the arguably 13-year economic expansion, with one brief pandemic-related hiccup, has seemingly come to an end.

The NBER is notorious for declaring recessions well after they have started and sometimes not until they have already ended. When managing our client assets, we keep a systematic approach based on up-to-date market and economic data and don’t need to wait on lagging declarations to effectively manage risk exposure.

If the shifting tides in our economic landscape are causing you or anyone you care about concern, please don’t hesitate to contact us. The best protection against environments like this is a strong comprehensive financial plan and an investment portfolio that matches all the characteristics decided by that financial plan.

Sources:

https://www.bea.gov/sites/default/files/2022-07/gdp2q22_adv.pdf

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.