Please provide your information and submit this form. Our team will be in touch with you shortly.

With Labor Day rapidly approaching and your recent high school graduate ready to head off to college, you have probably made a long to-do list and checked it twice. Dorm room décor, microwave-ready meals, and school supplies are just a few of the many things that need to be rounded up before the semester starts.

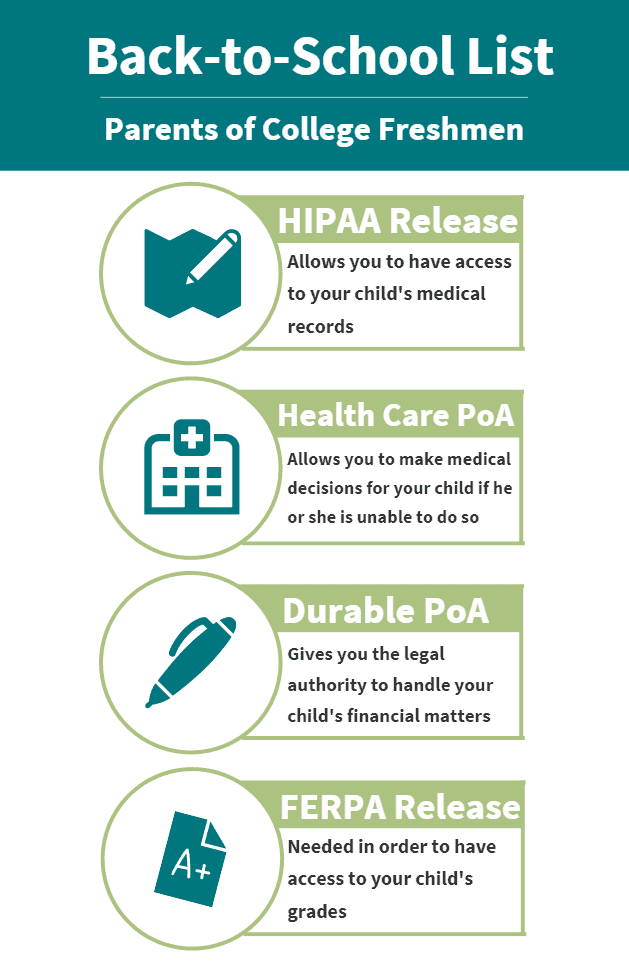

Now that they’re 18 years old and an adult (at least in the legal sense!) keep in mind these major financial to-dos that might be missing on your back-to-school lists:

- HIPAA Release

- Health Care Power of Attorney

- Durable Power of Attorney

- FERPA

First and foremost, have your children sign a HIPAA Release Form allowing you to have access to their medical records. If you don’t have this authorization doctors will not be able to discuss your children’s medical situations with you. This could range from simple visits to the campus health clinic to being admitted to the hospital after a car accident, even from a distance with this form you will be able to stay in the know.

Another important task to complete is to have your children designate you or another trusted individual as their Health Care Power of Attorney. This Health Care PoA designation allows you to make medical decisions for your children if they are unable to do so due to illness or incapacity.

Having your children designate a Durable Power of Attorney is an important step regarding their financial situation. If you are designated as your children’s Durable Power of Attorney, you have access to their bank account information. If you are still providing financial support to your children, this document also gives you the legal authority to directly handle their financial matters such as managing their student loans or investments. In order to have access to your college student’s grades, your student must consent. The Family Educational Rights and Privacy Act of 1974 (FERPA), is a federal law designed to protect the privacy of student records. With few exceptions, all student education records are considered confidential and may not be released without written consent of the student. This is true regardless of your student’s age and begins when the student enrolls in a higher education institution.

While it may seem like doing these tasks aren’t a high priority for college students, completing them will allow you to be there for your children when they need you the most.

Everyone’s situation is unique. This information is not intended to be a substitute for specific individualized legal advice, and we suggest you discuss your specific situation with a qualified legal advisor. As always, feel free to contact us with any questions as to how these issues may fit into your overall financial plan!

https://www.consumerreports.org/health-privacy/help-your-college-age-child-in-a-medical-emergency/

https://www.lplegal.com/content/why-your-college-bound-child-needs-a-power-of-attorney

https://www.natlawreview.com/article/happy-18th-birthday-your-college-aged-child-adult-now-what