By any measure, the tax code is huge. It is almost 75,000 pages long, with footnotes.1

And each Monday, the Internal Revenue Service publishes a 20- to 50-page bulletin about various aspects of the tax code.2

Fortunately, it’s not necessary to wade through these massive libraries to get a basic understanding of how income taxes work. Knowing a few key concepts may provide a solid foundation.

One of the key concepts is marginal income tax brackets.

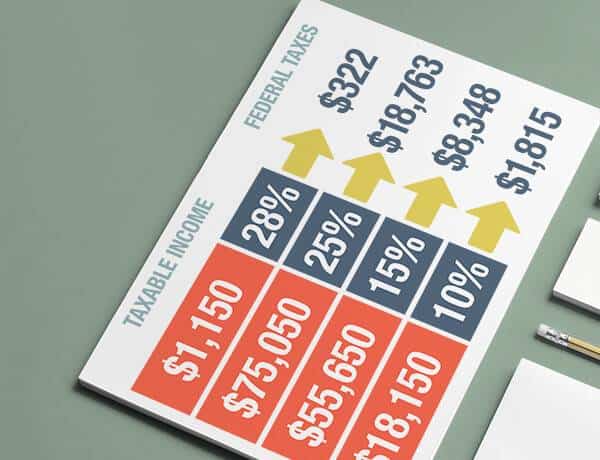

Taxpayers pay the tax rate in a given bracket only for that portion of their overall income that falls within that bracket’s range.

Tax Works

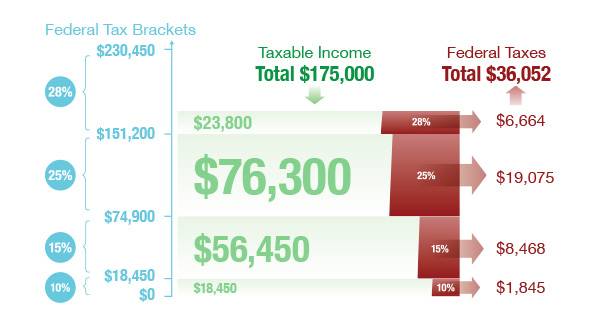

Seeing how marginal income tax brackets work is helpful because it shows the progressive nature of income taxes. It also helps you visualize how your total tax rate can be calculated. But remember, this material is not intended as tax or legal advice. Please consult a tax professional for specific information regarding your individual situation.

How Federal Income Tax Brackets Work

Say a married couple, filing jointly, in 2019, had a taxable income of $200,000. Each dollar over $168,400 – or $31,600 – would fall into the 24% federal income tax bracket. However, the couple’s total federal tax would be $36,289 – just under 20% of their adjusted gross income.

This is a hypothetical example used for illustrative purposes only. It assumes no tax credits apply.

2019 Federal Income Tax Brackets

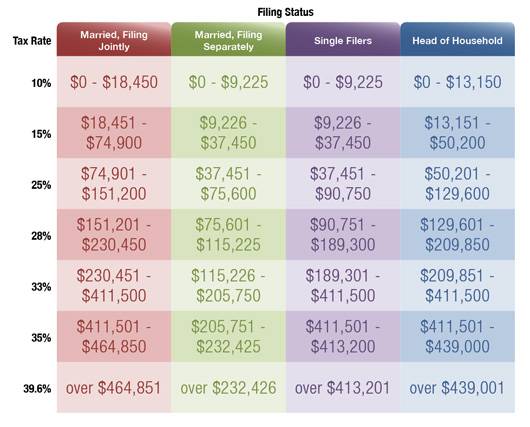

Your federal income tax bracket is determined by two factors: your total income and your tax-filing classification.

For the 2019 tax year, there are seven tax brackets for ordinary income – ranging from 10% to 37% – and four classifications: single, married filing jointly, married filing separately, and head of household.2

- Forbes, October 8, 2018

- Internal Revenue Service, 2019