Long-term care coverage can be complex. Here’s a list of questions to ask that may help you better understand the costs and benefits of these policies.

What types of facilities are covered? Long-term care policies can cover nursing home care, home health care, respite care, hospice care, personal care in your home, assisted living facilities, adult daycare centers, and other community facilities. Many policies cover some combination of these. Ask what facilities are included when you’re considering a policy.

What is the daily, weekly, or monthly benefit amount? Policies normally pay benefits by the day, week, or month. You may want to evaluate how (and how much) eldercare facilities in your area charge for their services before committing to a policy.

What is the maximum benefit amount? Many policies limit the total benefit they’ll pay over the life of the contract. Some state this limit in years, others in total dollar amount. Be sure to address this question.

What is the elimination period? Long-term care policy benefits don’t necessarily start when you enter a nursing home. Most policies have an elimination period – a timeframe during which the insured is wholly responsible for the cost of care. In many policies, elimination periods can range anywhere from zero to 100 days after nursing home entry or disability.1

Does the policy offer inflation protection? Adding inflation protection to a policy may increase its cost, but it could be very important as the price of long-term care may increase significantly over time.

When are benefits triggered? Insurers set some criteria for this. Commonly, long-term care policies pay out benefits when the insured person cannot perform 2 to 3 out of six activities of daily living (ADLs) without assistance. The six activities, cited by most insurance companies, include bathing, caring for incontinence, dressing, eating, toileting, and transferring. A medical evaluation of Alzheimer’s disease or other forms of dementia may also make the insured eligible for benefits.1,2

Is the policy tax qualified? In such a case, the policyholder may be eligible for a federal or state tax break. Under federal law and some state laws, premiums paid on a tax-qualified long-term care policy are considered tax-deductible medical expenses once certain thresholds are met. The older you are, the more you may be able to deduct under federal law. You must itemize deductions to qualify for such a tax break, of course.1,3

How strong is the insurance company? There are several firms that analyze the financial strength of insurance companies. Their ratings can give you some perspective.

What other policy options are available? Some insurers offer long-term care coverage permitting waiver of premium, which allows payments on the policy to end once benefits are triggered. In many states, policies are required to have a third-party notice feature, which prompts the insurer to notify a designated relative of the insured or a trusted professional when premiums have been missed, so that the situation may be addressed and payments may resume.2

There are many factors to consider when reviewing long-term care policies. The best policy for you may depend on a variety of factors, including your own unique circumstances and financial goals.

Touch of Grey

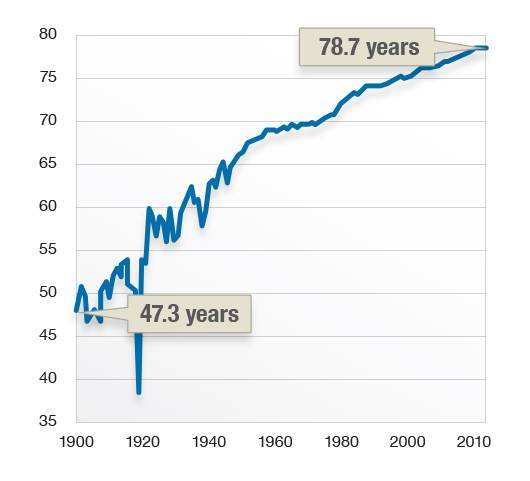

In 1900, the average life expectancy in America was 47.3 years. It now stands at 78.6 years, according to the most recent figures available from the Centers for Disease Control and Prevention.

Source: Washington Post, May 18, 2019

1. NerdWallet, May 28, 2019.

2. AllAboutLongTermCare.com, June 21, 2019.

3. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties.